Unknown Facts About Private Schools Debt Collection

Table of ContentsAll About Business Debt CollectionThe Of Business Debt CollectionThe Ultimate Guide To Debt Collection AgencyPrivate Schools Debt Collection for Beginners

A debt collector is an individual or company that is in business of recuperating money owed on delinquent accounts - Dental Debt Collection. Many debt collectors are worked with by firms to which money is owed by people, operating for a level charge or for a percentage of the amount they have the ability to collectA debt collector might also be called a debt collector. Right here is just how they function. A financial debt collection agency attempts to recover past-due debts owed to lenders. Financial obligation collection agencies are typically paid a portion of any kind of money they take care of to accumulate. Some debt collectors purchase overdue financial obligations from creditors at a price cut and afterwards look for to collect by themselves.

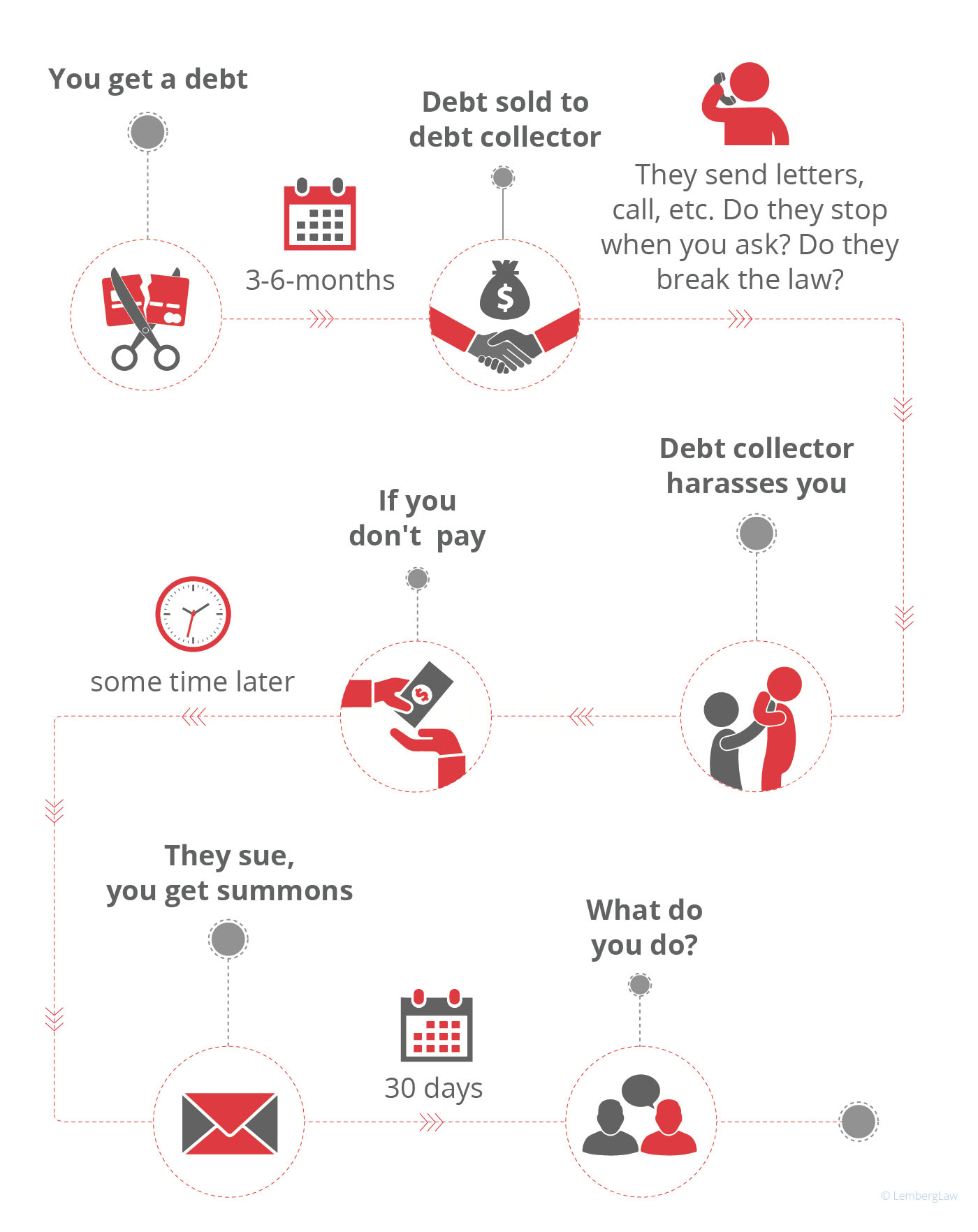

Financial obligation enthusiasts that violate the policies can be sued. When a consumer defaults on a financial obligation (significance that they have actually fallen short to make one or even more required settlements), the lender or creditor may turn their account over to a financial debt collector or collections company. At that factor the financial obligation is said to have mosted likely to collections.

Some firms have their very own financial obligation collection divisions. Most find it much easier to employ a debt collector to go after unpaid financial debts than to go after the clients themselves.

5 Simple Techniques For Personal Debt Collection

Financial debt collectors might call the individual's personal and also work phones, and even appear on their front door. They may likewise call their household, friends, as well as next-door neighbors in order to verify the contact information that they have on apply for the person. (Nonetheless, they are not permitted to disclose the factor they are trying to reach them.) Additionally, they might send by mail the debtor late repayment notices.

m. or after 9 p. m. Neither can they wrongly claim that a borrower will be detained if they stop working to pay. In addition, a collector can't literally injury or endanger a debtor and also isn't enabled to take assets without the approval of a court. The regulation also gives debtors particular civil liberties.

Both can continue to be on credit rating reports for as much as seven years as well as have an adverse effect on the person's credit rating, a huge section of which is based upon their payment background. No, the Fair Financial Debt Collection Practices Act uses just to customer debts, such as home mortgages, bank card, auto loan, pupil car loans, as well as clinical bills.

Some Known Facts About Personal Debt Collection.

When that happens, the internal revenue service will send the taxpayer an official notification called a CP40. Since rip-offs are usual, taxpayers ought to be wary of anybody purporting to be working with part of the IRS and also contact the IRS to make certain. That depends upon the state. Dental Debt Collection. Some states have licensing requirements for financial obligation enthusiasts, while others do not.

A financial obligation collection firm is a business that acts as middlemen, accumulating clients' delinquent debtsdebts that are at least 60 days previous dueand paying them to the original creditor. Discover a lot more about how financial debt collection agenies as well as financial obligation enthusiasts work. Dental Debt Collection.

Debt enthusiasts obtain paid when they recuperate overdue debt. Debt collection firms will go after any overdue financial debt, from past due pupil car loans to overdue clinical bills.

Some Known Factual Statements About Personal Debt Collection

For example, an agency might collect only overdue financial obligations of at least $200 as well as less than 2 years old. A trusted agency will certainly also limit its job to collecting financial debts within the statute of constraints, which varies by state. Being within the statute of constraints indicates that the financial debt useful site is not also old, as well as the creditor can still pursue it legally.

A financial debt collector needs to depend on the borrower to pay and can not take a paycheck or reach right into a checking account, also if the routing and account numbers are knownunless a judgment is acquired. look at this web-site This means the court orders a debtor to pay off a certain amount to a specific financial institution.

This judgment allows a collector to begin garnishing incomes and also savings account, however the collector needs to still contact the borrower's employer and financial institution to ask for the cash. Financial debt collectors likewise call delinquent debtors who already have judgments versus them. Even when a lender wins a judgment, it can be testing to accumulate the cash.

When the original financial institution determines that it is not likely to accumulate, it will certainly cut its losses by marketing that financial obligation to a financial obligation customer. Financial institutions package countless accounts along with similar attributes and also market them as a group. Financial debt customers can pick from plans that: Are reasonably brand-new, without any various other third-party collection task, Older accounts that collection agencies have stopped working to collect on, Accounts that drop somewhere in between Debt buyers typically buy these plans through a bidding process, paying usually 4 cents for each $1 of financial obligation face value.